The 56th GST Council meeting, chaired by Finance Minister Nirmala Sitharaman, has approved sweeping reforms aimed at simplifying the indirect tax structure, boosting consumption, and providing relief to both households and businesses.

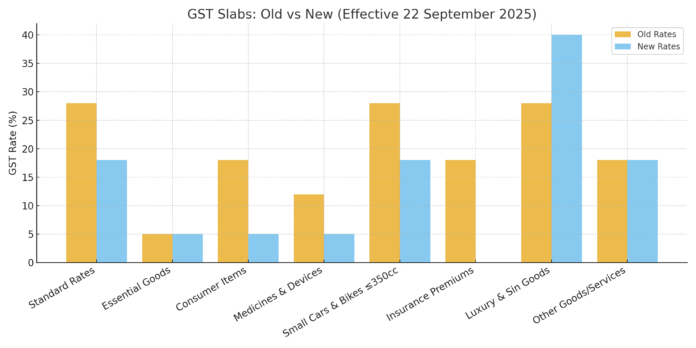

The Council has decided to slash the number of GST slabs from four to just two standard rates – 5% and 18%. This new structure will come into effect from September 22nd, 2025.

A special 40% “sin and luxury rate” has also been introduced for tobacco, cigarettes, pan masala, carbonated drinks, and high-end luxury goods, ensuring that essential and common-use items remain affordable while luxury consumption bears a higher tax burden.

The Council has moved hundreds of items into lower tax brackets. Everyday products such as hair oil, soaps, noodles, bicycles, utensils, essential medicines, and medical devices will now be taxed at 5%. Basic foods like UHT milk, paneer, and rotis will be exempted from GST altogether.

The Council also decided to reduce the tax on small cars and motorcycles up to 350cc from 28% to 18%, giving a significant push to the auto industry and benefiting middle-class families.

In a major relief to households, life and health insurance premiums have been exempted from GST, making policies more affordable for millions of citizens.

To ease compliance, the Council announced that MSME registrations will now be processed within just three days. Exporters will benefit from an automatic refund system designed to ensure faster liquidity and fewer delays in the refund cycle.

These reforms are expected to not only ease the burden on small and medium businesses but also stimulate demand in key sectors of the economy.

Another major decision was the move to operationalise the GST Appellate Tribunal (GSTAT) by December 2025. The tribunal will serve as a dedicated platform for addressing disputes, appeals, and compliance issues, reducing litigation burden on courts and strengthening trust in the GST framework.

The Finance Minister underlined that the changes are not merely about “tariff tinkering” but represent a structural reform of India’s GST regime. By creating a simpler, consumer-friendly tax system, the government aims to spur consumption, enhance compliance, and strengthen economic growth.